INVESTMENT

PORTFOLIO

MANAGEMENT

Premium Portfolios is a leading mutual fund advisory

firm in India that offers financial planning services

in Delhi NCR.

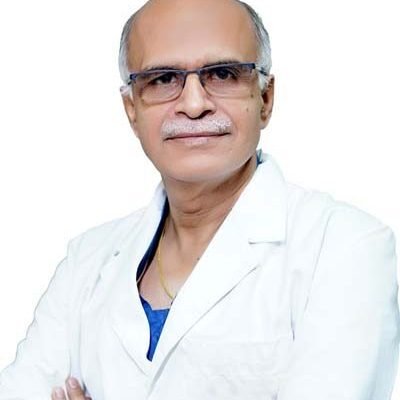

About the Founder

Vivek Madan, the founder, embarked on his independent journey in 2017 after gaining valuable expertise by working with various private sector banks in the Wealth Management / Investment advisory field for over a decade. From the start of his career, he focused on specializing in Wealth Management, offering exceptional services and consistently delivering returns through well-diversified and customized portfolios. As a Financial Consultant based in Delhi, Vivek Madan has spent the past seven years providing Financial Planning Services and Portfolio Management. His dedication goes beyond just generating returns; instead, he strives to create an all-encompassing financial experience to empower clients and help them achieve financial success that considers his client’s goals and aspirations.

Why Premium Portfolios?

Have any queries about

Customized Plans?

Elders and Seniors

Golden years ahead? Secure your Retirement Life and Enjoy peace of mind and financial stability today

Young Professionals

Young and ambitious? Our youth-focused funds are designed to help you achieve your financial goals.

Kids and Teenagers

Secure a bright future with smart investments to support young minds with tailored funds for education.

Travel and Leisure

Time is money! Time-bound funds are perfect for short-term goals. Invest wisely and watch your money grow.

Our Latest Videos

Subscribe to our channel to get the latest videos notification

Young Investors

Customized portfolios

Seniors

Retirement Plans

Teenagers

Student-Centric Plans

Investment Strategy

Start Smart Investing Today

Invest for Education

Education-Centric Investment

Women Empowerment

Financial Independence

Travel and Leisure

Time-Bound Portfolios

Middle Age

Financial Strategies

Follow us on social media

What My Clients Say About Me

Our Latest Blogs

Discover valuable tips, trends, and strategies in our newest blog posts.

Stay informed and empowered on your journey towards financial success.

Frequently Asked Questions

What is a mutual fund?

A mutual fund is a professionally managed investment scheme that pools money from multiple investors to invest in various securities like stocks, bonds, and other assets.

How do mutual funds work in India?

Mutual funds in India work by collecting funds from investors and then investing them in accordance with a specified investment objective. Investors buy units of the mutual fund, and the value of these units changes based on the performance of the underlying assets.

What are the types of mutual funds available in India?

Mutual funds in India can be categorized into various types such as equity funds, debt funds, hybrid funds, index funds, and thematic funds, among others. Each type has a different investment objective and risk profile.

What are the benefits of investing in mutual funds in India?

Mutual funds offer several benefits such as diversification, professional management, liquidity, convenience, and the potential for higher returns compared to traditional investment options like fixed deposits or savings accounts.

Can I redeem my mutual fund investment anytime?

Mutual fund investments in India generally offer liquidity, allowing investors to redeem their investments at any time. However, it’s important to check the exit load, if any, and consider the tax implications before redeeming the investment, especially for short-term investments.

What is SIP (Systematic Investment Plan) in mutual funds?

SIP is a method of investing a fixed amount regularly in mutual funds at predetermined intervals (usually monthly). It allows investors to benefit from rupee-cost averaging and the power of compounding over the long term.

How are mutual funds taxed in India?

The tax treatment of mutual funds in India depends on various factors such as the type of mutual fund (equity or debt), the holding period, and the investor’s tax status. Generally, equity mutual funds held for more than one year are taxed at a flat rate of 10% on gains exceeding ₹1 lakh, while debt mutual funds held for more than three years are taxed at 20% with indexation benefits.

What factors should I consider before investing in mutual funds in India?

Before investing in mutual funds in India, it’s essential to consider factors such as your investment goals, risk tolerance, investment horizon, the track record of the fund manager, expense ratio, fund performance, and the reputation of the AMC. Conducting thorough research and seeking professional advice can help in making informed investment decisions.

What is the minimum investment required for mutual funds in India?

The minimum investment amount required for mutual funds in India varies depending on the fund house and the type of scheme. It can range from as low as ₹500 to ₹5,000 or more. Some mutual funds also offer the option of starting with even smaller amounts through systematic investment plans (SIPs).

Are mutual funds in India regulated?

Yes, mutual funds in India are regulated by the Securities and Exchange Board of India (SEBI), which lays down regulations and guidelines to ensure investor protection, transparency, and proper conduct of mutual fund operations.

About Us

At Premium Portfolios, we believe in going beyond just generating returns. We take the time to truly understand our clients’ objectives, risk tolerance, and time horizon, enabling us to provide tailored investment solutions that align with their unique needs. Our commitment to excellence and client satisfaction sets us apart, making us a trusted choice for those seeking professional guidance and comprehensive financial planning services.

Visit Us

Address:

Eldeco Arcadia Shopping Complex,

Greater Noida -201310